The Cadillac XT5, positioned as a midsize luxury SUV within the Cadillac brand’s Chinese market lineup, targets consumer demographics seeking a blend of luxury and practicality.

The Cadillac XT5, positioned as a midsize luxury SUV within the Cadillac brand’s Chinese market lineup, targets consumer demographics seeking a blend of luxury and practicality.

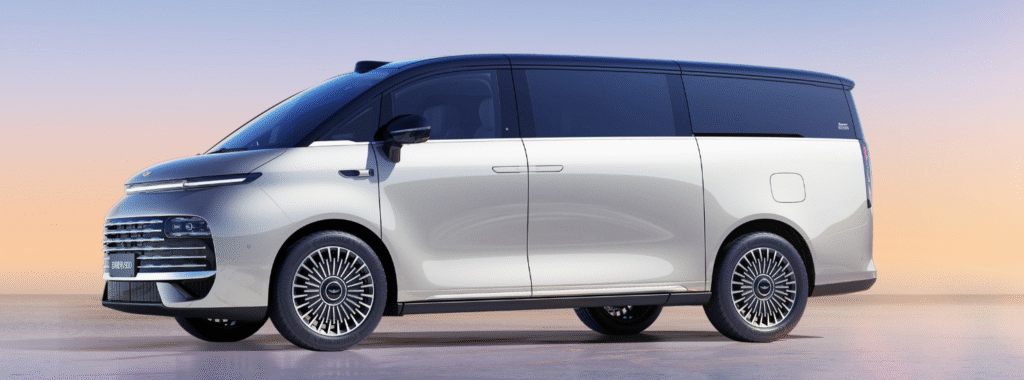

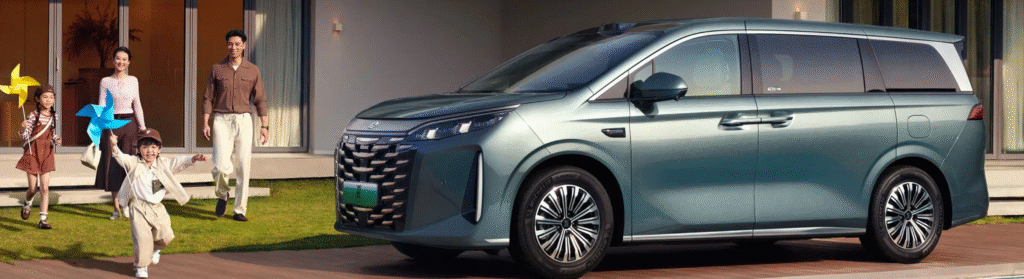

(2024.11.21,guangzhou China)the Geely Galaxy V900 made its global debut at the Guangzhou Auto Show, officially announcing the brand’s entry into the high-end MPV field. As a flagship model, it leverages the GEA Evo architecture to offer superior space, the FlymeAuto 2.0 intelligent cockpit, and super AI range-extending technology. With a pre-sale price range of approximately $41,250 to $61,900 USD (converted from 300,000 – 450,000 RMB), it challenges traditional luxury brands and new competitors with its comprehensive design and performance upgrades.

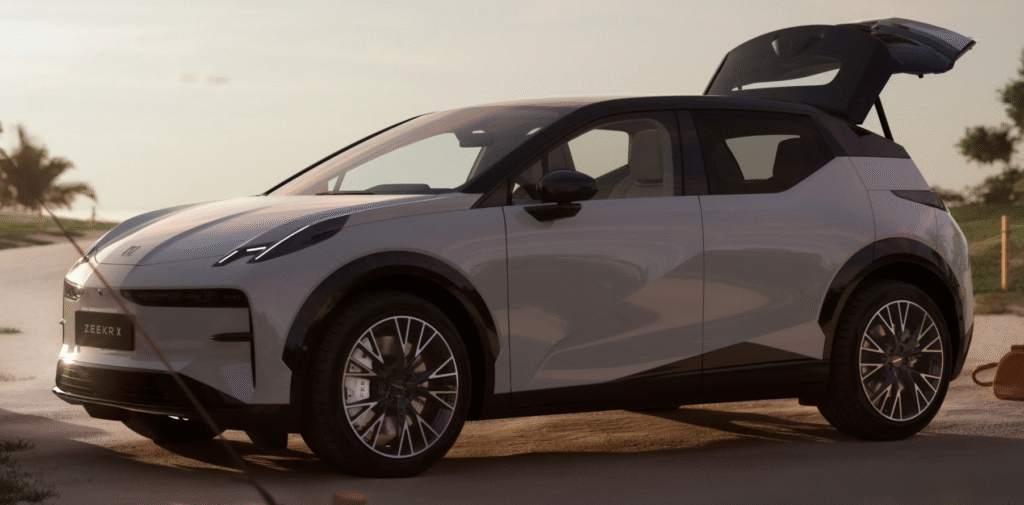

Zeekr, a subsidiary of Geely, today launched the refreshed Zeekr X. The model is available in three variants: the Max five-seater, Max four-seater, and Ultra five-seater, with starting prices of approximately $21,490, $22,041, and $24,248 respectively. Currently, a $1,379 trade-in subsidy is available. With the subsidy applied, the final prices would be approximately $20,110, $20,662, and $22,869 respectively.

Hongqi Guoya, as the new flagship luxury sedan under the Hongqi brand, was born not merely to launch a product, but to shoulder the mission of showcasing the highest standards of China’s automotive industry and a profound understanding of Eastern luxury.

Read More

“Li Auto “is a unique player in China’s new energy vehicle market. Since its founding in 2015 by Li Xiang, the company has consistently focused on creating mobile, warm spaces for family users. Its development history, while not long, has been clear and steady.

Read MoreIn the global automotive industry’s shift towards electrification, the Chinese market is undoubtedly at the forefront. It has not only fostered the world’s largest new energy vehicle consumer market but also given rise to a group of highly innovative and internationally competitive brands. Starting from different paths, they have collectively shaped today’s spectacular scene of “vying for supremacy.”

thanks fou you attention,we are coming soon….