In the global automotive industry’s shift towards electrification, the Chinese market is undoubtedly at the forefront. It has not only fostered the world’s largest new energy vehicle consumer market but also given rise to a group of highly innovative and internationally competitive brands. Starting from different paths, they have collectively shaped today’s spectacular scene of “vying for supremacy.”

To understand the current landscape, BYD is a starting point that cannot be overlooked. As a company that started with battery technology and grew into a global new energy vehicle giant, BYD’s success is no accident. By mastering core technologies across the entire industry chain—particularly the “three electrics” (battery, motor, electronic control)—it has built a formidable moat. From the mass-market “Dynasty” series (Han, Tang, Song, Qin) to the more youth-oriented “Ocean” series (Dolphin, Seal), BYD’s product matrix covers almost all mainstream price segments. Its annual sales exceeding 3 million units in 2023 not only demonstrate broad market acceptance but also cement its leadership position in China and globally.

While BYD swept the market with a stance of “technology for all,” a group of new automakers established around 2014 chose to enter the fray with a focus on premiumization and differentiation. Among them, NIO, Li Auto, and XPeng, collectively known as “Wei Xiao Li,” each carved out their own unique niches.

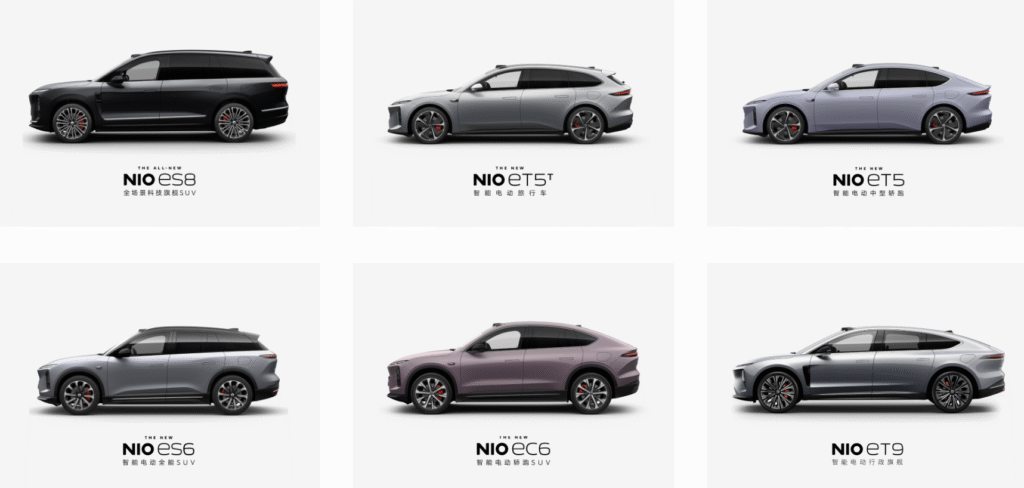

From its inception, NIO has been committed to redefining the relationship between users and the company. It aims to build not just a high-performance intelligent electric vehicle but also an refined community and service ecosystem built around the user. Its signature battery-swapping model offers a unique solution to range anxiety. From the elegant ET series sedans to the comfortable ES series SUVs, NIO has consistently maintained its position as a premium brand.

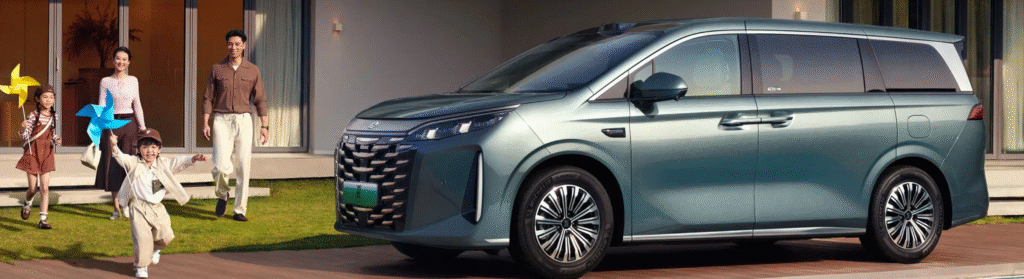

Li Auto demonstrates a profound understanding of the needs of Chinese family users. It astutely capitalized on the current practicality of the extended-range electric vehicle (EREV) technology, cleverly addressing range anxiety associated with pure electric vehicles. From the Li ONE to the L series (L9, L8, L7), its products are uniformly centered around spacious interiors, luxurious features, and excellent family entertainment functions, making it synonymous with the “dad mobile” category and achieving tremendous commercial success as a result.

XPeng has embedded “intelligence” into its brand DNA. It is often regarded as the “Tesla of China,” with continuous R&D investment in intelligent driver-assistance systems and smart cockpits. Its signature Navigation Guided Pilot (NGP) function showcases deep accumulation in autonomous driving technology, attracting many young users who seek cutting-edge tech. From the classic P7 coupe to the tech-laden G9 SUV, XPeng’s products consistently revolve around the technological experience.

Beyond these startups, traditional automotive giants have also incubated their own new energy contenders. Geely launched the premium electric brand Zeekr. Leveraging Geely’s Sustainable Experience Architecture (SEA), Zeekr’s first model, the 001, gained instant fame with its unique shooting brake design and exceptional performance. Subsequent models like the luxury MPV 009 and compact SUV X have continued its avant-garde, unconventional design language.

GAC Group’s Aion brand successfully charted a path from the business-to-business (B2B) market to penetrating the consumer market. After initially accumulating significant data and reputation through the ride-hailing sector, Aion rapidly gained traction in the private passenger vehicle market with highly cost-effective models like the Aion S and Aion Y, seeing steady sales growth and becoming a force to be reckoned with, particularly in southern China.

In the last two years, the biggest variable in the market has come from the cross-border entry of tech giants. The AITO brand, jointly created by Seres and Huawei, is a prime example of the “Huawei Inside” model. Huawei not only provides leading “three electrics” technology, the disruptive HarmonyOS smart cockpit, and advanced intelligent driving systems but also participates deeply in product definition, design, and channel sales. The explosive popularity of the AITO M7 vividly demonstrates the immense market appeal powered by Huawei’s brand and technological prowess.

Similarly, Xiaomi, a giant in the consumer electronics field, announced its car-making plans in 2021 and launched its first model, the Xiaomi SU7, in 2024. Xiaomi positions its greatest advantage in the “Human x Car x Home” full ecosystem connectivity, attempting to replicate its success in smartphones and smart homes within the automotive industry. Its entry adds another layer of intrigue to an already fiercely competitive landscape.

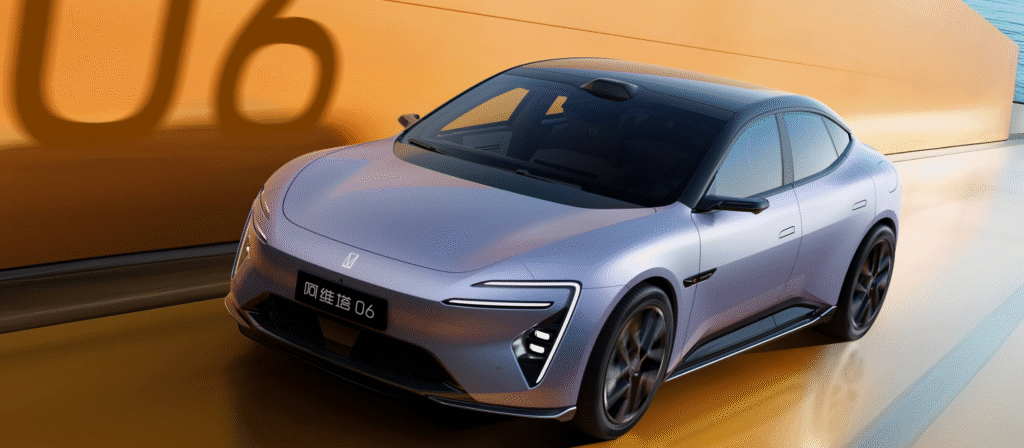

Furthermore, the Avatr brand, a joint venture between Changan Automobile, Huawei, and CATL, represents another “all-star” collaboration model, combining the strengths of its three parent companies to focus on the premium emotional intelligent electric vehicle segment.

In summary, the Chinese EV market has formed a dynamic structure: BYD stands as the “superpower,” “Wei Xiao Li,” Zeekr, Aion, and others constitute the “major powers,” while tech giants like Huawei and Xiaomi continuously inject new variables. It is a battleground where technological iteration is unprecedentedly fast, consumer demands are increasingly diverse, and competition is fiercely brutal. Yet, precisely this environment makes it the most active frontier of innovation in the global automotive industry. The future of mobility will undoubtedly be shaped by the players here.

发表回复